Biometric option for login of Android users.

-

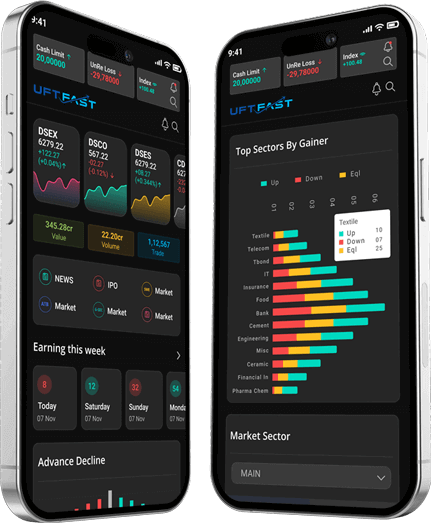

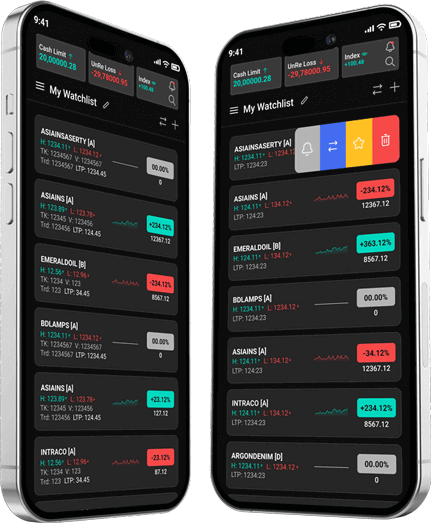

Android

-

IOS

-

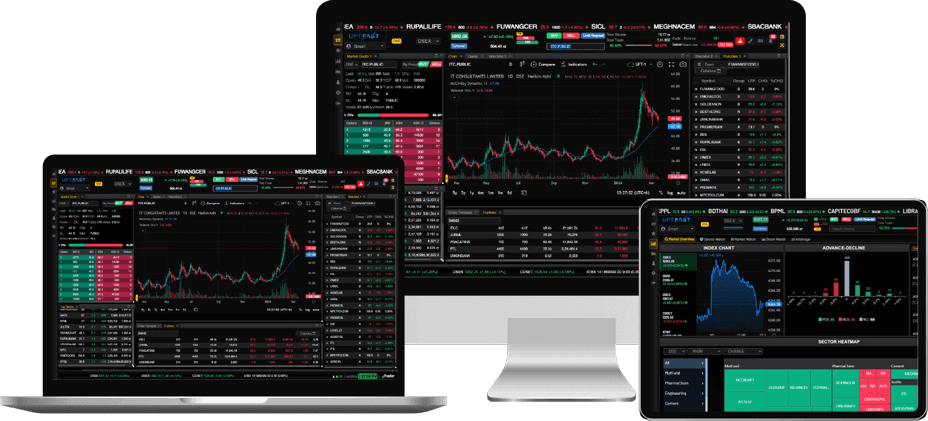

MAC

-

Windows

-

Web App

-

Web Browser